According to the

Center on Budget and Policy Priorities, Legislation currently pending before the House

would make significant cuts in a number of programs serving low- and moderate-income families and individuals, including Medicaid, child support enforcement, and student loans.

Supporters of the legislation defend the cuts as “tough choices” that need to be made because of large and growing budget deficits. These claims are undercut by the fact that, in the last six weeks, the House has passed four tax-cut bills that together cost more than twice what the budget reconciliation bill saves. The claims are further undermined by Congress’s unwillingness to rethink any previously enacted tax cuts as part of its supposed reevaluation of priorities in light of deficits.

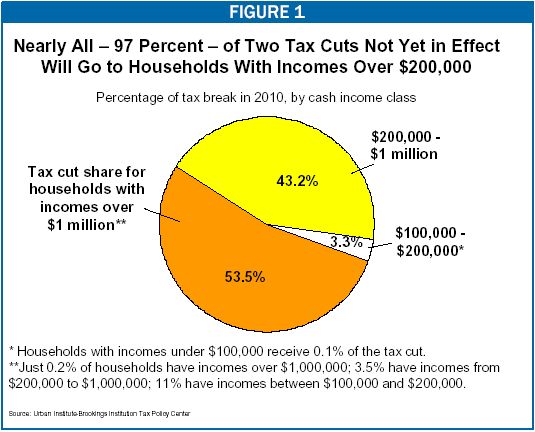

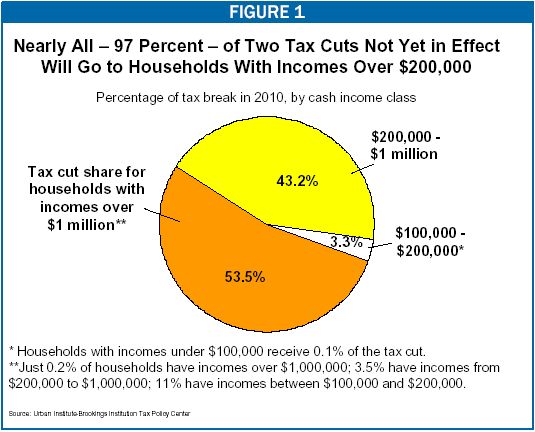

In particular, Congress has chosen to allow two tax cuts that exclusively benefit high-income households — primarily millionaires — to begin taking effect on January 1, 2006. By 2010, these tax cuts will eliminate two current provisions of the tax code that limit the value of the personal exemptions and itemized deductions that people at high income levels can take (see box below for more detail).

No comments:

Post a Comment