Monday, January 31, 2011

Core and stick prices

Paul Krugman notes that the Atlantic and Cleveland Fed produce inflation data based on flexible and sticky prices, not just core and headline prices. Here's the graph. It shows that stick is the thing to watch.

Sunday, January 30, 2011

Wednesday, January 26, 2011

The output gap

I'm finally beginning to understand what economists like Paul Krugman are getting at when they focus so heavily on the output gap. The output gap is the difference between what the economy could be producing if everyone who wanted to work were working in a way that took best advantage of their skills and what the economy is actually producing.

The economy's potential grows continually because (a) the population is increasing and (b) technology makes it possible to accomplish more with less effort. An estimate of the current rate of growth of the economy's potential is about 2.2%. That means that GDP must grow at that rate to keep up with population growth and technological advances. Any slower rate means either that people are un-/under-employed or that we are not using our skills and capabilities as well as we might.

Here's a graph (from EconBrowser) showing potential vs. actual.

It shows that our actual GDP is about $1 trillion (or 7%) less than it might be. The point isn't that material production is the most important thing. The point is that people who can and want to be productive don't have the means to do so. Not only that, but if given the chance to be productive, they would be, which would raise everyone's standard of living.

It is for this reason that Krugman and others urge that the Federal Government step in and provide "demand" to enable those people to work—and make everyone's life better. The waste that we are experiencing isn't necessary. So why put up with it? If there are people ready and willing to work, why not take advantage of that and let them do something useful. Why waste this potential when we don't have to?

Of course the question then becomes, what is that they should do? There seem to be two answers. One is to seed the economy with money so that the market—now that it has additional money—will determine how best to allocate that available effort. The other is to put them to work building stuff we know we need, like infrastructure creation and repair. The second is capital investment in society. It seems to me that that's a better way to put people to work. The existence of unemployment means that we have the luxury of upgrading out infrastructure. Why not take advantage of it.

Does government know what's the best infrastructure investments to make? Probably not absolutely. But we do want government to build some of our infrastructure. So it's not out of the question to expect government to build more of that infrastructure when people are unemployed than it would when the economy is functioning at full employment.

The economy's potential grows continually because (a) the population is increasing and (b) technology makes it possible to accomplish more with less effort. An estimate of the current rate of growth of the economy's potential is about 2.2%. That means that GDP must grow at that rate to keep up with population growth and technological advances. Any slower rate means either that people are un-/under-employed or that we are not using our skills and capabilities as well as we might.

Here's a graph (from EconBrowser) showing potential vs. actual.

It shows that our actual GDP is about $1 trillion (or 7%) less than it might be. The point isn't that material production is the most important thing. The point is that people who can and want to be productive don't have the means to do so. Not only that, but if given the chance to be productive, they would be, which would raise everyone's standard of living.

It is for this reason that Krugman and others urge that the Federal Government step in and provide "demand" to enable those people to work—and make everyone's life better. The waste that we are experiencing isn't necessary. So why put up with it? If there are people ready and willing to work, why not take advantage of that and let them do something useful. Why waste this potential when we don't have to?

Of course the question then becomes, what is that they should do? There seem to be two answers. One is to seed the economy with money so that the market—now that it has additional money—will determine how best to allocate that available effort. The other is to put them to work building stuff we know we need, like infrastructure creation and repair. The second is capital investment in society. It seems to me that that's a better way to put people to work. The existence of unemployment means that we have the luxury of upgrading out infrastructure. Why not take advantage of it.

Does government know what's the best infrastructure investments to make? Probably not absolutely. But we do want government to build some of our infrastructure. So it's not out of the question to expect government to build more of that infrastructure when people are unemployed than it would when the economy is functioning at full employment.

Word of the moment: curator

Have you noticed how many things are being curated these days? It's not a bad word. It means that a person is responsible for selecting, organizing, and looking after a collection. I've been noticing this for a while. A recent example was in an ad for a restaurant in which the wine list was said to be curated by someone. It was brought to mind immediately by an email from TED in which Chris Anderson (who is not the Chris Anderson of Wired) calls himself the "TED Curator."

Norway and Ireland Surpass U.S. in Productivity

From David Leonhardt at NYTimes.com

[In last night's State of the Union address] President Obama [claimed] that American workers are the most productive in the world. …Recall also our previous post about Norway as the socialist home of entepreneurialism.

[The] best measure of productivity is probably output per hour … By that measure, our own Bureau of Labor Statistics reports that the United States trails at least two other countries, Norway and Ireland.

Norway and Ireland have something else in common. A decade and a half ago, they both trailed the United States in education attainment. In the United States, 33 percent of young adults in 1995 received a four-year college degree in the mid-1990s, compared with 26 percent in Norway and 30 percent or less in Ireland. …

Since the mid 1990s, though, Norway and Ireland have passed us. By 2008, the United States had increased its college graduation rate to merely 37 percent, while Norway was at 41 percent and Ireland at 46 percent.

Caleb Scharf

has put his answers to The Ten Most Important Questions for Astrobiology into a single GoogleDoc file. (I wish he had made it a simple pdf.) When I asked GoogleDocs to save the page, I got this URL, which I find much easier to read. (When I first loaded it I got an error message, but when I asked the page to reload, it was successful. Is it visible to everyone or just me?) I guess the document is the same; taking it out of the GoogleDocs context makes it more attractive—at least for me.

Tuesday, January 25, 2011

Jeff Weintraub: Kenneth Arrow & Frank Hahn put Smith’s theory of the market in perspective

I would have left this comment on the blog, but comments don't seem to be open.

Regarding, Jeff Weintraub: Kenneth Arrow & Frank Hahn put Smith’s theory of the market in perspective, the post quotes Arrow and Hahn saying it is not so obvious

Where does the creativity come from? It results from the fact that market economies take advantage of more of the intelligence in the overall system than other economic systems. In a market economy one has many points of perception and intelligence that are continually searching the environment for opportunities. That sort of distributed intelligence is simply not possible in a centrally controlled system. It is by encouraging distributed intelligence and by enabling it to contribute its insights to the economy that market systems gain their great advantage.

Regarding, Jeff Weintraub: Kenneth Arrow & Frank Hahn put Smith’s theory of the market in perspective, the post quotes Arrow and Hahn saying it is not so obvious

that a decentralized economy motivated by self-interest and guided by price signals would be compatible with a coherent disposition of economic resources that could be regarded, in a well-defined sense, as superior to a large class of possible alternative dispositions. Moreover, the price signals would operate in a way to establish this degree of coherence. It is important to understand how surprising this claim must be to anyone not exposed to the tradition. The immediate "common sense" answer to the question "What will an economy motivated by individual greed and controlled by a very large number of different agents look like?" is probably: There will be chaos.As we found out recently, equilibrium is not quite as automatic as this suggests. In addition, I think that the emphasis on markets as an efficient way to allocate resources and to stabilize an economy overlooks an important point. One of the most significant things about market based economies is their creativity. That in my view is even more important than stability. After all, stability is easy in a top-down economy as well. It's creativity that's hard. And creativity is not always compatible with stability and equilibrium. But it's generally worth the cost of the meta-market mechanisms necessary to shield a society from the disequilibria created by creativity.

Where does the creativity come from? It results from the fact that market economies take advantage of more of the intelligence in the overall system than other economic systems. In a market economy one has many points of perception and intelligence that are continually searching the environment for opportunities. That sort of distributed intelligence is simply not possible in a centrally controlled system. It is by encouraging distributed intelligence and by enabling it to contribute its insights to the economy that market systems gain their great advantage.

Caleb Sharf always has something interesting to say

He's an exobiologist at Columbia, someone who looks for life on other planets.

A key clue as to why the Siberian Traps could have profoundly affected the planet has been the suggestion that this volcanic region would have ignited massive coal deposits. As these burned they would have dumped colossal amounts of ash, carbon dioxide and other combustion byproducts like sulfuric acid, and even methane into the atmosphere. Now a new work in Nature Geoscience by Grasby et al. describes the discovery of precisely the kind of ash deposits in the rock record of far northern Canada that would have been produced by the Siberian volcanoes. Not only that, but the nature of this ash is very similar to that produced by modern industrial coal use, suggesting that toxic slurry would have been pouring into the late Permian marine environment.

What is particularly interesting to my mind, which harks back to earlier posts, is that obviously the coal deposits that the Siberian lava ignited were themselves the product of a much earlier era of rich plant life - perhaps during the Carboniferous period some 300-360 million years ago. At the risk of greatly oversimplifying things it nonetheless seems that the exuberant growth of plant life, together with circumstances that led to burial and fossilization as coal, some 50 million years before the late Permian helped set a time-bomb for future organisms. I think we (astronomers, exoplanetary scientists) tend to ignore this kind of factor when we discuss planetary habitability. Extinction events are sometimes seen as random or disconnected from the deeper planetary history. Did it really matter what happened a hundred million years earlier if an asteroid comes plunging in or a super-volcano erupts? For the late Permian it looks like it did matter.

Monday, January 24, 2011

This is an amazing animation

Note that it repeats. The full 8:11 video is two copies of one 4:05 videos. Don't know why they did that.

Sunday, January 23, 2011

Entrepreneurialism and taxes: not what you think

There's a great article in Inc. about entrepreneurialism in Norway. The bottom line is that although Norway is one of the most socialist countries in the world it's also one of the most entrepreneurial.

[There] is precious little evidence to suggest that [low taxes in the US] have done much for entrepreneurs—or even for the economy as a whole. "It's actually quite hard to say how tax policy affects the economy," says Joel Slemrod, a University of Michigan professor who served on the Council of Economic Advisers under Ronald Reagan. Slemrod says there is no statistical evidence to prove that low taxes result in economic prosperity. Some of the most prosperous countries—for instance, Denmark, Sweden, Belgium, and, yes, Norway—also have some of the highest taxes. Norway, which in 2009 had the world's highest per-capita income, avoided the brunt of the financial crisis: From 2006 to 2009, its economy grew nearly 3 percent. The American economy grew less than one-tenth of a percent during the same period. Meanwhile, countries with some of the lowest taxes in Europe, like Ireland, Iceland, and Estonia, have suffered profoundly. The first two nearly went bankrupt; Estonia, the darling of antitax groups like the Cato Institute, currently has an unemployment rate of 16 percent. Its economy shrank 14 percent in 2009.Here's the entire article.

Moreover, the typical arguments peddled by business groups and in the editorial pages of The Wall Street Journal— the idea, for instance, that George W. Bush's tax cuts in 2001 and 2003 created economic growth—are problematic. The unemployment rate rose following the passage of both tax-cut packages, and economic growth during Bush's eight years in office badly lagged growth during the Clinton presidency, before the tax cuts were passed.

And so the case of Norway—one of the most entrepreneurial, most heavily taxed countries in the world—should give us pause. What if we have been wrong about taxes? What if tax cuts are nothing like weapons or textbooks? What if they don't matter as much as we think they do?

In Norway, Start-ups Say Ja to SocialismWe venture to the very heart of the hell that is Scandinavian socialism—and find out that it’s not so bad. Pricey, yes, but a good place to start and run a company. What exactly does that suggest about the link between taxes and entrepreneurship?By Max Chafkin | Jan 20, 2011

Wiggo Dalmo is a classic entrepreneurial type: the Working-Class Kid Made Good.

Dalmo, who is 39, with sandy blond hair and an easy smile, grew up in modest circumstances in a blue-collar town dominated by the steel industry. After graduating from high school, he apprenticed as an industrial mechanic and got a job repairing mining equipment.

He liked the challenge of the work but not the drudgery of working for someone else. "I never felt like there was a place for me as an employee," Dalmo explains as we drive past spent chemical drums and enormous mounds of scrap metal on the road that leads to his office. When he needed an inexpensive part to complete a repair, company rules required Dalmo to fill out a purchase order and wait days for approval, when he knew he could simply walk into a hardware store and buy one. He resented this on a practical level—and as an insult to his intelligence. "I wanted more responsibility at my job, more control," he says. "I wanted freedom."

In 1998, Dalmo quit his job, bought a used pickup truck, and started calling on clients as an independent contractor. By year's end, he had six employees, all mechanics, and he was making more money than he ever had. Within three years, his new company, Momek, was booking more than $1 million a year in revenue and quickly expanding into new lines of business. He built a machine shop and began manufacturing parts for oil rigs, and he started bidding on and winning contracts to staff oil drilling sites and mines throughout the country. He kept hiring, kept bidding, and when he looked around a decade later, he had a $44 million company with 150 employees.

As his company grew, Dalmo adopted the familiar habits of successful entrepreneurs. He bought a Porsche, a motorcycle, and a wardrobe of polo shirts with his corporate logo on the chest. As rock music blasts from the speakers in his office, Dalmo tells me that he is proud of the company he has created. "We tried to build a family, and we have succeeded," he says. "I have no friends outside this company."

This is exactly the kind of pride I often hear from the CEOs I have met while working at Inc., but for one important difference: Whereas most entrepreneurs in Dalmo's position develop a retching distaste for paying taxes, Dalmo doesn't mind them much. "The tax system is good—it's fair," he tells me. "What we're doing when we are paying taxes is buying a product. So the question isn't how you pay for the product; it's the quality of the product." Dalmo likes the government's services, and he believes that he is paying a fair price.

This is particularly surprising, because the prices Dalmo pays for government services are among the highest in the world. He lives and works in the small city of Mo i Rana, which is about 17 miles south of the Arctic Circle in Norway. As a Norwegian, he pays nearly 50 percent of his income to the federal government, along with a substantial additional tax that works out to roughly 1 percent of his total net worth. And that's just what he pays directly. Payroll taxes in Norway are double those in the U.S. Sales taxes, at 25 percent, are roughly triple.

Last year, Dalmo paid $102,970 in personal taxes on his income and wealth. I know this because tax returns, like most everything else in Norway, are a matter of public record. Anyone anywhere can log on to a website maintained by the government and find out what kind of scratch a fellow Norwegian taxpayer makes—be he Ole Einar Bjørndalen, the famous Norwegian biathlete, or Ole the next-door neighbor. This, Dalmo explains, has a chilling effect on any desire he might have to live even larger. "When you start buying expensive stuff, people start to talk," says Dalmo. "I have to be careful, because some of the people who are judging are my potential customers."

Welcome to Norway, where business is radically transparent, militantly egalitarian, and, of course, heavily taxed. This is socialism, the sort of thing your average American CEO has nightmares about. But not Dalmo—and not most Norwegians. "The capitalist system functions well," Dalmo says. "But I'm a socialist in my bones."

Norway, population five million, is a very small, very rich country. It is a cold country and, for half the year, a dark country. (The sun sets in late November in Mo i Rana. It doesn't rise again until the end of January.) This is a place where entire cities smell of drying fish—an odor not unlike the smell of rotting fish—and where, in the most remote parts, one must be careful to avoid polar bears. The food isn't great.

Bear strikes, darkness, and whale meat notwithstanding, Norway is also an exceedingly pleasant place to make a home. It ranked third in Gallup's latest global happiness survey. The unemployment rate, just 3.5 percent, is the lowest in Europe and one of the lowest in the world. Thanks to a generous social welfare system, poverty is almost nonexistent.

Norway is also full of entrepreneurs like Wiggo Dalmo. Rates of start-up creation here are among the highest in the developed world, and Norway has more entrepreneurs per capita than the United States, according to the latest report by the Global Entrepreneurship Monitor, a Boston-based research consortium. A 2010 study released by the U.S. Small Business Administration reported a similar result: Although America remains near the top of the world in terms of entrepreneurial aspirations -- that is, the percentage of people who want to start new things—in terms of actual start-up activity, our country has fallen behind not just Norway but also Canada, Denmark, and Switzerland. [Emphasis added.]

If you care about the long-term health of the American economy, this should seem strange—maybe even troubling. After all, we have been told for decades that higher taxes are without-a-doubt, no-question-about-it Bad for Business. President Obama recently bragged that his administration had passed "16 different tax cuts for America's small businesses over the last couple years. These are tax cuts that can help America—help businesses...making new investments right now."

Since the Reagan Revolution, which drastically cut tax rates for wealthy individuals and corporations, we have gotten used to hearing these sorts of announcements from our leaders. Few have dared to argue against tax cuts for businesses and business owners. Questioning whether entrepreneurs really need tax cuts has been like asking if soldiers really need weapons or whether teachers really need textbooks—a possible position, sure, but one that would likely get you laughed out of the room if you suggested it. Or thrown out of elected office.

Taxes in the U.S. have fallen dramatically over the past 30 years. In 1978, the top federal tax rates were as follows: 70 percent for individuals, 48 percent for corporations, and almost 40 percent on capital gains. Americans as a whole paid the ninth-lowest taxes among countries in the Organization for Economic Cooperation and Development, a group of 34 of the largest democratic, market economies. Today, the top marginal tax rates are 35 percent, 35 percent, and 15 percent, respectively. (Even these rates overstate the level of taxation in America. Few large corporations pay anywhere near the 35 percent corporate tax; Warren Buffett has famously said that he pays 18 percent in income tax.) Only two countries in the OECD—Chile and Mexico—pay a lower percentage of their gross domestic product in taxes than we Americans do.

But there is precious little evidence to suggest that our low taxes have done much for entrepreneurs—or even for the economy as a whole. "It's actually quite hard to say how tax policy affects the economy," says Joel Slemrod, a University of Michigan professor who served on the Council of Economic Advisers under Ronald Reagan. Slemrod says there is no statistical evidence to prove that low taxes result in economic prosperity. Some of the most prosperous countries—for instance, Denmark, Sweden, Belgium, and, yes, Norway—also have some of the highest taxes. Norway, which in 2009 had the world's highest per-capita income, avoided the brunt of the financial crisis: From 2006 to 2009, its economy grew nearly 3 percent. The American economy grew less than one-tenth of a percent during the same period. Meanwhile, countries with some of the lowest taxes in Europe, like Ireland, Iceland, and Estonia, have suffered profoundly. The first two nearly went bankrupt; Estonia, the darling of antitax groups like the Cato Institute, currently has an unemployment rate of 16 percent. Its economy shrank 14 percent in 2009.

Moreover, the typical arguments peddled by business groups and in the editorial pages of The Wall Street Journal— the idea, for instance, that George W. Bush's tax cuts in 2001 and 2003 created economic growth—are problematic. The unemployment rate rose following the passage of both tax-cut packages, and economic growth during Bush's eight years in office badly lagged growth during the Clinton presidency, before the tax cuts were passed.

And so the case of Norway—one of the most entrepreneurial, most heavily taxed countries in the world—should give us pause. What if we have been wrong about taxes? What if tax cuts are nothing like weapons or textbooks? What if they don't matter as much as we think they do?

I'm sure I've already pissed off some people with that question—and not just the rich ones. It's hard these days to say anything positive about taxes without being accused of economic treason. President Barack Obama's health care plan and his proposal to allow certain Bush tax cuts to expire in 2012—a move that would cause the top marginal tax rate on individuals to go up by 4.6 basis points, to the rate that prevailed in the late 1990s—have caused the administration to be eviscerated by business groups and their allies. "We are essentially undoing the very thing that has made America exceptional: the free enterprise system," wrote congressional candidate (and now a Republican congressman from New York) Richard Hanna in a letter published by the National Federation of Independent Business. "We can no longer devalue the energy of the entrepreneur this way." Newt Gingrich, a presidential hopeful and the former Speaker of the House, has called Obama's presidency the first step toward "European socialism and secularism," which he has suggested is a greater threat to our country than Islamic terrorism.

The idea that Americans should be more terrified of Norwegian economists than of al Qaeda bombmakers is pretty nutty, but I couldn't help wondering: How bad would European socialism really be? What if President Obama's health care and tax policies—which so far have been modest by European standards—are just the beginning? What if his proposal to allow the income tax rate on the richest Americans to rise by several basis points is just the first step? What if, say, by some crazy backdoor dealing involving Joe Biden, Nancy Pelosi, and the Ghost of Ted Kennedy, liberals manage something more sweeping: taxes of 50 percent, a government-run health care system, an expansion of Social Security, and sweeping regulations on business?

In other words, instead of some American version of European socialism, what if we got the genuine article? What if the nightmare scenario were real? What if you woke up tomorrow as a CEO in a socialist country?

To answer this question, I spent two weeks in Norway, seeking out entrepreneurs in all sorts of industries and circumstances.I met fish farmers in the country's northern hinterlands and cosmopolitan techies in Oslo, the capital. I met start-up founders who were years away from having to worry about making money and then paying taxes on it, and I met established entrepreneurs who every year fork over millions of dollars to the authorities. (Norway's currency is the kroner. I have converted all figures in this article to dollars.)

The first thing I learned is that Norwegians don't think about taxes the way we do. Whereas most Americans see taxes as a burden, Norwegian entrepreneurs tend to see them as a purchase, an exchange of cash for services. "I look at it as a lifelong investment," says Davor Sutija, CEO of Thinfilm, a Norwegian start-up that is developing a low-cost version of the electronic tags retailers use to track merchandise.

Sutija has a unique perspective on this matter: He is an American who grew up in Miami and, 20 years ago, married a Norwegian woman and moved to Oslo. In 2009, as an employee of Thinfilm's former parent company, he earned about $500,000, half of which he took home and half of which went to the Kingdom of Norway. (The country's tax system is progressive, and the highest tax rates kick in at $124,000. From there, the income tax rate, including a national insurance tax, is 47.8 percent.) If he had stayed in the U.S., he would have paid at least $50,000 less in taxes, but he has no regrets. (For a detailed comparison, see "How High Is Up?") "There are no private schools in Norway," he says. "All schooling is public and free. By being in Norway and paying these taxes, I'm making an investment in my family."

For a modestly wealthy entrepreneur like Sutija, the value of living in this socialist country outweighs the cost. Every Norwegian worker gets free health insurance in a system that produces longer life expectancy and lower infant mortality rates than our own. At age 67, workers get a government pension of up to 66 percent of their working income, and everyone gets free education, from nursery school through graduate school. (Amazingly, this includes colleges outside the country. Want to send your kid to Harvard? The Norwegian government will pick up most of the tab.) Disability insurance and parental leave are also extremely generous. A new mother can take 46 weeks of maternity leave at full pay—the government, not the company, picks up the tab—or 56 weeks off at 80 percent of her normal wage. A father gets 10 weeks off at full pay.

These are benefits afforded to every Norwegian, regardless of income level. But it should be said that most Norwegians make about the same amount of money. In Norway, the typical starting salary for a worker with no college education is a very generous $45,000, while the starting salary for a Ph.D. is about $70,000 a year. (This makes certain kinds of industries, such as textile manufacturing, impossible; on the other hand, technology businesses are very cheap to run.) Between workers who do the same job at a given company, salaries vary little, if at all. At Wiggo Dalmo's company, everyone doing the same job makes the same salary.

The result is that successful companies find other ways to motivate and retain their employees. Dalmo's staff may consist mostly of mechanics and machinists, but he treats them like Google engineers. Momek employs a chef who prepares lunch for the staff every day. The company throws a blowout annual party—the tab last year was more than $100,000. Dalmo supplements the standard government health plan with a $330-per-employee-per-year private insurance plan that buys employees treatment in private hospitals if a doctor isn't immediately available in a public one. These benefits have kept turnover rates at Momek below 2 percent, compared with 7 percent in the industry.

But it takes more than perks to keep a worker motivated in Norway. In a country with low unemployment and generous unemployment benefits, a worker's threat to quit is more credible than it is in the United States, giving workers more leverage over employers. And though Norway makes it easy to lay off workers in cases of economic hardship, firing an employee for cause typically takes months, and employers generally end up paying at least three months' severance. "You have to be a much more democratic manager," says Bjørn Holte, founder and CEO of bMenu, an Oslo-based start-up that makes mobile versions of websites. Holte pays himself $125,000 a year. His lowest-paid employee makes more than $60,000. "You can't just treat them like machines," he says. "If you do, they'll be gone."

If the Norwegian system forces CEOs to be more conciliatory to their employees, it also changes the calculus of entrepreneurship for employees who hope to start their own companies. "The problem for entrepreneurship in Norway is it's so lucrative to be an employee," says Lars Kolvereid, the lead researcher for the Global Entrepreneurship Monitor in Norway. Whereas in the U.S., about one-quarter of start-ups are founded by so-called necessity entrepreneurs—that is, people who start companies because they feel they have no good alternative—in Norway, the number is only 9 percent, the third lowest in the world after Switzerland and Denmark, according to the Global Entrepreneurship Monitor.

This may help explain why entrepreneurship in Norway has thrived, even as it stagnates in the U.S. "The three things we as Americans worry about—education, retirement, and medical expenses—are things that Norwegians don't worry about," says Zoltan J. Acs, a professor at George Mason University and the chief economist for the Small Business Administration's Office of Advocacy. Acs thinks the recession in the U.S. has intensified this disparity and is part of the reason America has slipped in the past few years. When the U.S. economy is booming, the absence of guaranteed health care isn't a big concern for aspiring founders, but with unemployment near double digits, would-be entrepreneurs are more cautious. "When the middle class is shrinking, the pool of entrepreneurs is shrinking," says Acs.

The downside to Norway's security, of course, is that it is expensive. Norway has substantial oil reserves—but most of the proceeds are invested abroad in a sovereign wealth fund. Norway's generous social benefits are financed largely from taxes that fall heavily on the country's richest people. The most controversial of these taxes is a wealth tax, a 1.1 percent annual levy on the entirety of a person's holdings above about $117,000, including stock in private companies held by the owner.

In search of an opinion on how such soak-the-successful policies affect the truly successful, I visited the tiny town of Misvær, a mountain hamlet in the country's interior, 38 miles north of the Arctic Circle. To get to Misvær, I took a small plane from Oslo to Bodø, where I was met by a gorgeous twentysomething blonde in a flight suit. She was, I somehow knew instantly, the pilot for Inger Ellen Nicolaisen, the country's answer to Donald Trump and the most flamboyant character in a country that prefers its wealthy to go about their business modestly.

After a short helicopter ride over a fjord and some mountains, we touch down in a snow-covered backyard, where we are greeted by a positively feudal scene: Nicolaisen trots out from the house, a modernistic structure perched far above the rest of the town like some enormous suburban castle, followed by five dogs—two Great Danes, two toy poodles, and a bulldog. She has shoulder-length platinum blond hair and wears teal contact lenses and knee-high boots, looking entirely unlike the 52-year-old mother of three that she is. "Welcome to Miami," she yells above the roar of the helicopter.

She leads me inside, where we are attended by a pair of servants who bring us coffee, pastries, and, though it's not quite noon, champagne. Nicolaisen's husband—her second, a 39-year-old former professional soccer player— eventually shows up and immediately begins assisting the servants. Later, he shows me around the grounds on a six-wheel all-terrain vehicle. There are the grazing sheep, the three teepees equipped with heat, electricity, and full bars—Nicolaisen uses the structures for corporate retreats—and the pack of Icelandic horses. As we rumble around on the ATV, it seems clear to me that these are the sort of people who should be animated by the wealth tax—and who won't mind saying so.

But they aren't, not really. Although Nicolaisen considers herself a conservative, she told me the issue that most animates her is poverty, not taxes. "Yeah, the wealth tax is a problem," she says. "But you have to make a choice. You can live in the Cayman Islands and pay no tax. But I don't want to live in the Cayman Islands. To live in Norway, you have to do what you have to. I think it's worth it."

Nicolaisen is famous for being the host of the country's version of The Apprentice and for founding Nikita, the largest chain of hair salons in Scandinavia. Over 26 years, Nikita has expanded into a hair care conglomerate called Raise, whose concerns include a line of private-label products and 120 salons in Norway and Sweden. Nicolaisen owns the $60 million company outright. Her story, which she tells in a best-selling memoir, Drivkraft—Norwegian for driving force—is a triumph of scrappiness. Nicolaisen dropped out of high school at 14, when she became pregnant. In her late teens, she supported herself and her daughter, Linda, by hawking handmade children's clothes. In her early 20s, she moved to Bodø and got a job as the receptionist in a hair salon. She took up with the salon's owner, they eventually married, and she got hooked on the hair business.

Nicolaisen was never much of a stylist, but her entrepreneurial ambitions quickly outstripped her husband's."My first goal was five salons—that seemed like a big goal," says Nicolaisen. She would eventually divorce her husband and take over the business completely. By 2000, she had expanded to 50 salons, and she found herself at a crossroads. She was booking $21 million in revenue a year, and the company was throwing off enough cash to allow her to live well. "I had to decide: Should I relax, stop growing, and just earn a lot of money, or should I expand?" she says. "I realized I couldn't stop there, so I set the next goal at 500. Because, you know—5, 50, 500—it made sense."

I would have thought that Norway's tax system would discourage this kind of thinking, but it doesn't seem to have been a factor. When I asked her why she bothered growing, she said simply, "I'm an entrepreneur. It's in my backbone."

This was the attitude of even those entrepreneurs who strenuously objected to the Norwegian tax regimen, which I learned when I traveled to Stokmarknes and visited the region's best-known entrepreneur, Inge Berg. Berg's company, a fish-farming enterprise called Nordlaks, is a half-hour's flight north of Bodø. The cold North Atlantic waters there make for ideal spawning grounds for salmon, cod, and herring.

We hop into an inflatable skiff and, with Berg in the cockpit, motor across the fjord to one of the company's 23 fish farms. There are three floating pens, barely visible from a distance, each housing 50,000 teenage salmon jostling to catch the food pellets that are being blown over the pens from a nearby barge. When Berg started as a fish farmer, it was his job to hand-feed the fish, dumping bucket after bucket of feed over the pens.

From the farm, we take the boat back to Berg's slaughterhouse and packing facility, where the same salmon will eventually meet their demise at a breathtaking rate of one fish per second. "One of the reasons we've been successful is that we've focused exclusively on salmon and trout farming—some other companies tried to expand to the tourist industry or the cod industry," Berg says over the din of the machines. "We invest everything in improving the process." Berg proudly catalogs a number of innovations—a flash-freezing process, a robotic packing system, and a fish oil plant that ensures that no fish scrap is wasted. For now, the oil is mainly used in livestock feed, but Berg brags that he has made sure it is approved for human consumption, then proves his point by pouring me a shot of the viscous pink liquid. (It smelled and tasted awful, but to his point, I did not die.)

In 2009, Nordlaks pulled in $62 million in profits on revenue of $207 million, making Berg, the sole owner, a very rich man. Although the Norwegian wealth tax includes generous deductions that allow Berg to report a net worth of about $30 million, far less than he would net if he sold his company, his tax bill is still substantial. Even if Nordlaks made no profits, paid no dividends, and paid its owner no salary, Berg would owe the Norwegian government a third of a million dollars a year. "Every year, I have to take a dividend, just to pay the tax," he says, sounding genuinely angry.

Berg is successful enough that paying the wealth tax is no hardship—in 2009, he took a dividend of nearly $10 million—but when a company slips into the red, entrepreneurs can find themselves in trouble. "If a company grows to a large size and then has two bad years in a row, the founder may be forced to sell some stock," says Erlend Bullvåg, a business-school professor at the University of Nordland and an adviser to the Norwegian central bank. But none of the entrepreneurs I spoke with had been forced to sell stock to pay their taxes—and Bullvåg, who has interviewed dozens of entrepreneurs on behalf of the Norwegian central bank, hasn't encountered a case personally. Berg told me that he hadn't given much thought to the wealth tax; he didn't even know exactly how it was calculated. "I get so pissed sometimes," he says. "But you just have to look forward, and it passes."

The posting of tax returns online makes tax evasion nearly impossible in Norway, but it doesn't stop the very rich from fleeing the country altogether. The best-known example is John Fredriksen, a shipping tycoon worth $7.7 billion and at one time the richest Norwegian. In 2006, Fredriksen, who had kept most of his personal assets outside the country to avoid taxes, renounced his Norwegian citizenship. He became the richest man in Cyprus.

Fredriksen's past is murky—he is reputed to have been one of the only exporters willing to do business with Iran after the revolution—and he rarely gives interviews. But in 2008, he told The Wall Street Journal, "It's almost impossible to do business in Norway today." Norway's prime minister, Jens Stoltenberg, dismissed the defection as no great loss—Fredriksen hadn't paid personal taxes in Norway for decades, and his companies continue to pay taxes in the country. Even so, Fredriksen is something of a folk hero to the entrepreneurs in his former home.

"He is cool," says Jan Egil Flo, chief financial officer of Moods of Norway, a $35 million clothing company in Stryn. I visited Moods of Norway's offices on my last day in Norway and chatted with Flo and his co-founders, Simen Staalnacke and Peder Børresen. The three were able to start their company, which makes fashionable sportswear and suits, largely thanks to the beneficence of the Norwegian socialist system. In 2004, they received a $20,000 start-up grant from the Norwegian equivalent of the Small Business Administration. Staalnacke and Børresen enrolled in a local college, because doing so meant the government would cover most of their living expenses. This may be why, when I ask the three founders if they might become Cypriots anytime soon, they protest. "No, no, no," says Børresen. "We've received a lot from Norway and Norwegian society. Giving back is not a problem."

Moods of Norway operates 10 boutiques, which, in a country of five million, means the company has saturated its home market. Two years ago, it opened its first store in the U.S., a 2,500-square-foot space in Beverly Hills, and Flo is in negotiations to open stores in New York City's SoHo neighborhood and Mall of America in Minnesota. It has been more challenging than he expected. "It's much easier to do business in Norway," Flo says. "The U.S. isn't one country; it's 50 countries." Although Norway may be more heavily regulated than America, the regulations are uniform across the country and are less apt to change drastically when the political winds blow.

In addition to regulatory stability, Flo pointed to a number of other advantages his company enjoys in Norway. Although personal taxes on entrepreneurs are high, the tax rate on corporate profits is low—28 percent, compared with an average of about 40 percent in combined federal and state taxes in the U.S. A less generous depreciation schedule and higher payroll taxes in Norway more than make up for that difference—Norwegian companies pay 14.1 percent of the entirety of an employee's salary, compared with 7.65 percent of the first $106,800 in the U.S.—but that money pays for benefits such as health care and retirement plans. "There's no big difference in cost," Flo says. In fact, his company makes more money, after taxes, on items sold in Norway than it does on those sold in its California shop.

Flo is pushing his business into America for reasons that have nothing to do with our tax structure. He wants Moods of Norway to be here because America is the largest, most influential market in the world. "There are more Norwegians in the Minneapolis area than in Norway," Flo says excitedly. "If you can get known in America, then the whole world knows you."

I heard this sort of sentiment from lots of the entrepreneurs I spoke with in Norway. They talked about the ambition and aggressiveness of American culture, which can't help breeding success. The younger entrepreneurs yearned for our tradition of mentoring, whereby seasoned entrepreneurs help nascent ones, with money or advice or both.

The more time I spent with Norwegian entrepreneurs, the more I became convinced that the things that make the United States a great country for entrepreneurs have little to do with the fact that we enjoy relatively low taxes. Kenneth Winther, the founder of the Oslo management consultancy MoonWalk, regaled me for hours about the virtues of Norway—security, good roads, good schools. But at the end of our interview, he confessed that he had been hedging his bets: He intended to apply to the American green-card lottery in January. "Why not try?" he said with a shrug.

I also became convinced of this truth, which I have observed in the smartest American and the smartest Norwegian entrepreneurs: It's not about the money. Entrepreneurs are not hedge fund managers, and they rarely operate like coldly rational economic entities. This theme runs through books like Bo Burlingham's Small Giants, about company owners who choose not to maximize profits and instead seek to make their companies great; and it can be found in the countless stories, many of them told in this magazine, of founders who leave money on the table in favor of things they judge to be more important.

At one point, I asked Wiggo Dalmo why he was still working so hard to expand his company: Why not just have a nice life—especially given that the authorities would take a hefty chunk of whatever additional money he made? "For me personally, building something to change the world is the kick," he says. "The worst thing to me is people who chose the easiest path. We should use our wonderful years to do something on this earth."

When I got back to the United States, I had a beer with Bjørn Holte, the CEO of bMenu, whom I'd first met in Oslo. It was early November—days after the congressional elections—and Holte had just arrived in New York City, where he is opening a new office. We talked about the commercial real estate market, the amazing cultural diversity in a city that has twice as many people as his entire country, and the current debate in the United States about the role of government. Holte was fascinated by this last topic, particularly the angry opposition to President Obama's health care reform package. "It makes me laugh," he says. "Americans don't understand that you can't have a functioning economy if people aren't healthy."

Holte's American subsidiary pays annual health care premiums that make his head spin—more than $23,000 per employee for a family plan—and that make the cost of employing a software developer in the United States substantially higher than it is in Norway, even after taxes. (For a full breakdown, see "Making Payroll.") Holte is no pinko—he finds many aspects of Norwegian socialism problematic, particularly regulations about hiring and firing—but when he looks at the costs and benefits of taxes in each country, he sees no contest. Norway is worth the cost.

Of course, that's only half the question when it comes to taxes. The other, more divisive question is, What is fair? Is it right to make rich people pay more than poor people? Would paying a greater percentage of our income for more government services make us less free? "I'd rather be in the U.S., where you can enjoy the fruit of your labor, rather than a country like Norway, where your hard work is confiscated by the government," says Curtis Dubay, senior tax policy analyst at the Heritage Foundation, a Washington, D.C., think tank that advocates for lower taxes.

These are important moral issues, but, in America, they are often the only ones we are willing to consider. We have, as Holte suggests, become religious about economic policy. We are unable or unwilling to make the kind of cool-headed calculations about costs and benefits that I saw in Norway. "There's a disconnect in the way people think about paying taxes and funding public services that's worse here than in any other country," says Donald Bruce, a tax economist at the University of Tennessee. "We refuse to believe that taxes can be used for anything productive. But then we say, 'Stay out of my Social Security. And my Medicare. And don't cut defense or national parks.' "

Our collective inability to have a rational conversation about taxes will have consequences. In 2010, the American budget deficit hit $1.3 trillion, or 10 percent of GDP. By 2035, the deficit could be close to 16 percent of GDP, according to the report issued late last year by the National Commission on Fiscal Responsibility and Reform. That report prescribed dramatic spending cuts and tax increases. But just weeks after it was released, President Obama and congressional Republicans unveiled a new package of tax cuts, which will add an extra $800 billion to the deficit over two years.

Obama has said he hopes to allow these cuts to expire in 2012 and for income tax rates to revert to levels of the 1990s, and that is only one of many revenue-generation ideas kicking around in policy circles. There are also proposals for a tax on millionaires, a national sales tax, and even a dreaded, Norwegian-style wealth tax.

When lawmakers inevitably take up these issues, it's a sure thing that those who oppose raising revenue through tax hikes will make the argument that higher taxes will hurt entrepreneurs. They will make it sound as if even a modest tax increase would represent a death knell for American business. But the case of Norway suggests that Americans should view these arguments with skepticism—and that American entrepreneurs could stand to be less dogmatic about the role of government in society.

This isn't to say that entrepreneurs don't have a right to get angry about taxes—or to fight tax increases in the same way they might fight any price increase by a supplier. It is to say only that, despite what you hear from Washington politicians and activist groups, the tax rate is probably far from the most important issue facing your business. Entrepreneurs can thrive under almost any regime, even the scourge of European socialism. "Taxes matter, but their effect is small in magnitude," says Bruce. "In the end, decisions entrepreneurs make are about more important things: Is there a market for what you're making? Are you doing something relevant for the economy? If the answer is no, then taxes don't matter much."

Max Chafkin is Inc.'s senior writer.

Copyright © 2011 Mansueto Ventures LLC. All rights reserved.

Inc.com, 7 World Trade Center, New York, NY 10007-2195.

Saturday, January 22, 2011

Wednesday, January 19, 2011

James Kwak tells it like it is

From Eric Cantor, Deficit Hawkoprite

Eric Cantor, House Republican Majority Leader, said the Republicans will demand spending cuts in exchange for the votes necessary to raise the debt ceiling.

Eric Cantor, member of Congress, voted for:

The 2001 tax cut

The 2003 tax cut

The 2003 Medicare prescription drug benefit

The 2010 tax cut

In other words, of the big five budget-busting measures of the past decade, the only one he didn’t vote for was the 2009 stimulus. In other words, he had the opportunity to vote for $3.1 trillion of the 2011 debt, and he voted for 75 percent, or $2.3 trillion — just like most Republicans who were in Congress for those five votes.

For explanation and sources, see this post.

Sunday, January 16, 2011

What will happen to labor?

Mark Thoma reproduces an exchange about whether Adam Smith was wrong when he wrote that increasing specialization would result in higher standards of living for all. The basic argument is that as work becomes increasingly specialized (as in an assembly line where each station does one specialized operation) the work required of any laborer will become less and less sophisticated. This means that any worker can be replaced by any other, which in turn means that labor rates will decline to the lowest level sufficient for survival. Technology only makes this worse since the more that work is automated, the less need there is for workers.

One of the responses was that if there are very few workers, there will be very few consumers. So the benefit derived from producing more for less is reduced. But I think there is another answer.

Let's assume that 10% of the population has a good job and that the other 90% are either living on substance wages or are unemployed. Let's ignore the social instability that will cause and just look at the economics. The question I would ask is what would the 10% do with all the money they are earning? Money by itself is of no value unless you can buy something with it. But once the 10% have satisfied their basic needs and their immediate desires, they still have money. So what do they do with it? The only answer I can think of is that they hire some of the unemployed to do more for them or to make more for them.

Working as someone's servant is not the best job. But working as an entertainer is often quite lucrative. And working in an industry that produces non-necessary but desirable goods (like a fancy car) can also provide a good living. The basic point is that unless the rich do nothing with their money, they will spend a lot of it. (They can't invest it all if the economy has too little demand because most people are too poor to buy things.)

This sounds like a trickle down theory of economics: let the rich get rich, and the rest will follow. I'm not a big fan of that theory, but it seems to have something going for it.

I guess the question becomes whether wealth will eventually even itself out. In a country with an aristocracy and a peasantry, what leads to the rise of a middle class? What prevents the rich and powerful from becoming even more rich and powerful and taking everything? As I said, in the big picture if they take everything, there will be no one left to sell things to. But where will it settle out? What determines what the Gini coefficient for a society looks like? But even that is not the best measure of overall well-being in a society. For example, according to Wikipedia, most modern European countries have relatively low Gini coefficients—which means less inequality. But so do Albania, Belarus, and Kazakhstan. The US Gini coefficient is about the same as that of Cameroons, Uruguay, Uganda, and the Philippines.

One of the responses was that if there are very few workers, there will be very few consumers. So the benefit derived from producing more for less is reduced. But I think there is another answer.

Let's assume that 10% of the population has a good job and that the other 90% are either living on substance wages or are unemployed. Let's ignore the social instability that will cause and just look at the economics. The question I would ask is what would the 10% do with all the money they are earning? Money by itself is of no value unless you can buy something with it. But once the 10% have satisfied their basic needs and their immediate desires, they still have money. So what do they do with it? The only answer I can think of is that they hire some of the unemployed to do more for them or to make more for them.

Working as someone's servant is not the best job. But working as an entertainer is often quite lucrative. And working in an industry that produces non-necessary but desirable goods (like a fancy car) can also provide a good living. The basic point is that unless the rich do nothing with their money, they will spend a lot of it. (They can't invest it all if the economy has too little demand because most people are too poor to buy things.)

This sounds like a trickle down theory of economics: let the rich get rich, and the rest will follow. I'm not a big fan of that theory, but it seems to have something going for it.

I guess the question becomes whether wealth will eventually even itself out. In a country with an aristocracy and a peasantry, what leads to the rise of a middle class? What prevents the rich and powerful from becoming even more rich and powerful and taking everything? As I said, in the big picture if they take everything, there will be no one left to sell things to. But where will it settle out? What determines what the Gini coefficient for a society looks like? But even that is not the best measure of overall well-being in a society. For example, according to Wikipedia, most modern European countries have relatively low Gini coefficients—which means less inequality. But so do Albania, Belarus, and Kazakhstan. The US Gini coefficient is about the same as that of Cameroons, Uruguay, Uganda, and the Philippines.

Is it all better?

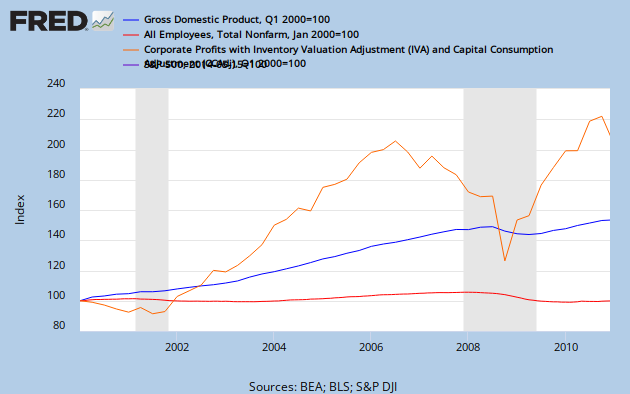

I've seen the graph below many times. It looks like the "great recession" took a significant cut out of the economy, but it also looks like we've recovered. Have we? Of course not; we still have over 9% unemployment. It looks like we won't get back to a normal level of employment for a number of years.

Look at this graph—my first attempt to use FRED. It shows that employment is below its level at the start of this century whereas corporate profits and GDP are way above. The green line in the middle represents the total US population. The orange is corporate profits. All lines are scaled to an index that starts at 100 on Jan 1, 2000.

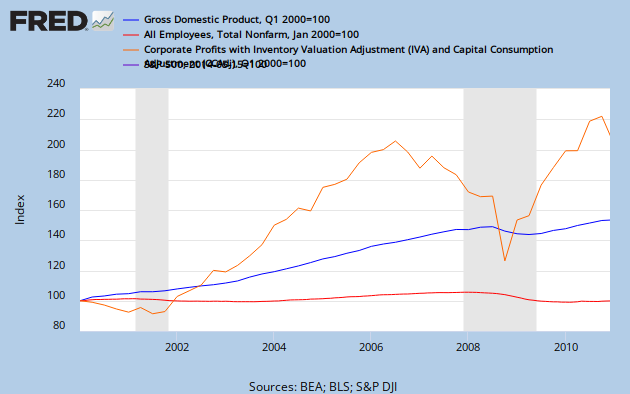

This next graph substitutes the S&P500 for the population. (Apparently FRED is limited to 4 lines at a time.)

I'm surprised to see how corporate quarterly profits lead the stock market. I thought it was supposed to be the other way around!

I'm surprised to see how corporate quarterly profits lead the stock market. I thought it was supposed to be the other way around!

Look at this graph—my first attempt to use FRED. It shows that employment is below its level at the start of this century whereas corporate profits and GDP are way above. The green line in the middle represents the total US population. The orange is corporate profits. All lines are scaled to an index that starts at 100 on Jan 1, 2000.

This next graph substitutes the S&P500 for the population. (Apparently FRED is limited to 4 lines at a time.)

I'm surprised to see how corporate quarterly profits lead the stock market. I thought it was supposed to be the other way around!

I'm surprised to see how corporate quarterly profits lead the stock market. I thought it was supposed to be the other way around!

Joe Nocera on the iPhone

With Verizon, iPhone’s Flaws May Become More Apparent - NYTimes.com

[F]or all that it offers, the iPhone has always been plagued by serious drawbacks. The “phone” part of the iPhone has never worked very well, dropping calls with annoying regularity. Even when the phone works, the sound quality is often substandard. You would think in an age when fewer people are using landlines this would matter. Apparently not.

Meanwhile, the iPhone’s lack of a raised keyboard makes it next to impossible to do serious e-mailing. And users have to worry constantly about battery life; if they’re not judicious, the iPhone’s battery can be drained by noon. …

Apple’s chief operating officer, Timothy D. Cook, was asked why Apple wasn’t going with [Verizon’s] faster, newer 4G LTE network. Mr. Cook replied that doing so required “design compromises” that Apple was unwilling to make.

They never make design compromises at Apple. They make consumer compromises. Yet consumers have always been willing to overlook those compromises so they can claim they own some of the coolest products on the planet.

“People so love their devices from Apple that they are willing to put up with the stupidities,” said Larry Keeley, president of the innovation and design firm Doblin. “For many users,” he added, “especially the ones Apple loves the most, the fact that the battery gets balky is how you convince yourself to get a new one.” …

The Apple-AT&T marriage has been a public relations disaster — for AT&T. Its network was quickly overwhelmed, in part because it was subpar, and in part because iPhone owners — with a mobile computer at their fingertips — used astonishing amounts of data: 15 times more than the average smartphone user, and “50 percent more than AT&T itself had projected,” according to Fred Vogelstein, who wrote about the problems for Wired magazine.

Mr. Vogelstein went on to note in his article that the troubles that ensued — the dropped phone calls, the frequent network crashes and so on — were not entirely AT&T’s fault. His Apple sources, he wrote, confirmed to him that “the software running the iPhone’s main radio, known as baseband, was full of bugs and contributed to the much-decried dropped calls.” But since Apple walks on water, and AT&T doesn’t, it was easy for Apple to place all the blame on its wireless carrier. Which it gleefully did. …

Here’s the shocker, though. According to Gartner, in the second quarter of 2009, Android sales constituted 1.8 percent of all smartphones sold, compared with Apple’s 13 percent. By the second quarter of 2010 — just a year later — Android was actually outselling Apple, 17.2 percent to 14.2 percent. This must have been a shock to the system at Apple — it was being outdone by an uncool competitor.

Saturday, January 15, 2011

Republicans Call Obama Policies "Job Killers" Because the Media Might Ask for Evidence If They Called Them "Baby Killers

Great headline from Dean Baker. Republicans Call Obama Policies "Job Killers" Because the Media Might Ask for Evidence If They Called Them "Baby Killers". It's amazing what the Republicans get away with. They are very good at finding the edge at which they won't be challenged.

Monday, January 10, 2011

American Airlines Sucks

I had a reservation on American Airlines:

Los Angeles → New York → Boston → Los Angeles

While in New York I found that I could drive to Boston with friends. I called American hoping for at least some miles in exchange for giving them an extra seat to sell. (This was during the Christmas rush.) Instead they told me that if I didn't pay them more money they would cancel my return flight to Los Angeles.

After numerous interchanges with their customer service representatives, I found that apparently the customer is always wrong. In the twisted world of American Airlines relinquishing a leg was an "itinerary change"—and they insisted that my ticket required me to pay extra for any "itinerary change."

In the future I will do my best never to fly American Airlines again.

I guess I'm not alone in feeling this way about American Airlines. Here are a few of the images I found after a quick search for American Airlines Images. (Click the image to go to the page where the image was found.)

[Click here for "American Airlines Sucks" links that Google has indexed within the past year.]

Sunday, January 09, 2011

It's hard to notice when moving objects change

This is quite amazing!

Instructions: Keep your eyes fixed on the small white mark in the center. At first, the ring is stationary and it's easy to tell that the dots are changing. A few seconds later, the ring begins to rotate and the dots suddenly appear to stop changing.

But play the movie again, this time looking directly at one of the dots and following it as the ring rotates. You will see that, in fact, the dots had been changing the whole time, even during the rotation—you just didn’t notice it. This failure to detect that moving objects are changing is [called] silencing.See more here: Motion silences awareness of color changes from Jordan Suchow on Vimeo.

Saturday, January 08, 2011

Job losses

The 2001 recession (brown line) and this one (red line) have had the longest lasting effects on jobs. From Calculated Risk.

Sorry for not posting.

Although we're still in the depths of the "great recession," Obama has created more jobs in one year than Bush did in 8.

Subscribe to:

Posts (Atom)