Paul Krugman wonders why (through what mechanism) has quantitative easing (QE2) worked—to the extent that hit has. Previously the Fed affected the economy through its effect on housing. But that can't be the case this time. So what is it? He suspects that QE2 has had its effect through encouraging high-end consumption. That is, people with money in the stock market, primarily people who have money, have made lots of money recently and have therefore been more willing to spend it. So instead of encouraging housing the Fed has encouraged consumption by giving people with money more money.

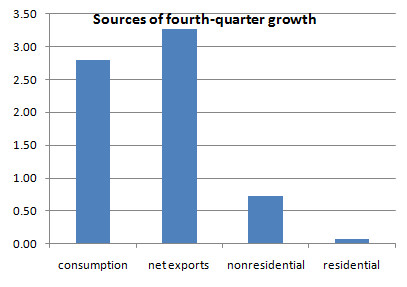

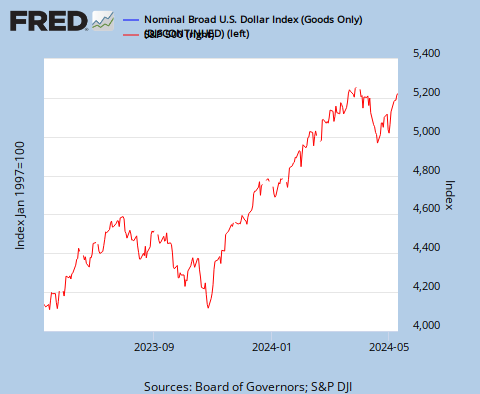

Paul Krugman wonders why (through what mechanism) has quantitative easing (QE2) worked—to the extent that hit has. Previously the Fed affected the economy through its effect on housing. But that can't be the case this time. So what is it? He suspects that QE2 has had its effect through encouraging high-end consumption. That is, people with money in the stock market, primarily people who have money, have made lots of money recently and have therefore been more willing to spend it. So instead of encouraging housing the Fed has encouraged consumption by giving people with money more money. The other major contributor to the economy has been an increase in the balance of exports over imports. That's been the result—at least in part—of a weaker dollar, possibly also a consequence of QE2. Krugman's two supporting charts are to the right.

The bottom chart tracks ETFs over the past 6 months for consumer discretionary spending (XLY), consumer staples spending (XLP), and the S&P 500 (SPY).

No comments:

Post a Comment