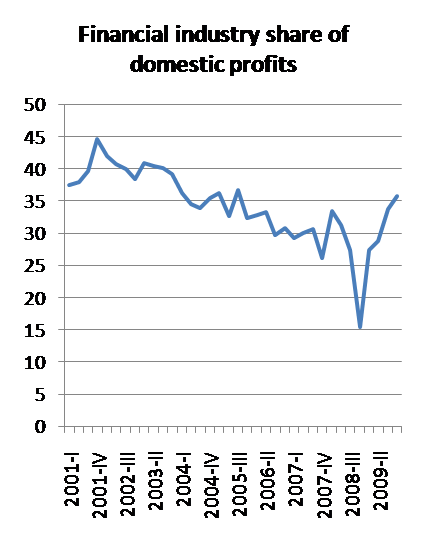

Back in early 2009 I was skeptical about the ability of major banks to recapitalize themselves out of profits. I was wrong, it turns out. Here’s why:

Financial-industry profits have soared, probably because banks that can borrow money cheaply — because they have an implicit guarantee from the feds — are more or less guaranteed money machines unless they do something stupid; and gross stupidity has been placed temporarily on hold.

This has been good for the TARP, which won’t lose much money.

Beyond that, however, I find this ominous. We got into this mess because we had an over-financialized economy, with finance making a share of profits out of all proportion to its actual economic contribution. And now it’s baaaack.

Wednesday, April 14, 2010

The Secret of the Banks’ Success

The Secret of the Banks’ Success - Paul Krugman Blog - NYTimes.com

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment