Another great piece by the

Center on Budget and Policy Priorities

.

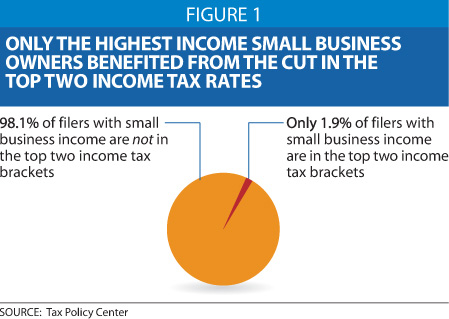

Many of the roughly 650,000 filers with small-business income who face one of the top two tax rates are merely passive investors who have nothing to do with running the business. This is because the Tax Policy Center data cited above use the Treasury Department’s relatively broad definition of “small business.” Under the Treasury definition, for example, the $84 of income President Bush received in 2001 from a passive investment in an oil and gas company[7] made him a “small-business owner.” About 35 percent of “small-business owners” with incomes above $200,000, and about 58 percent of “small-business owners” with incomes over $1 million, received some or all of their business income in the form of passive investments. The Treasury definition also counts as “small-business income” the fees that CEOs are paid for sitting on corporate boards.

Many of the roughly 650,000 filers with small-business income who face one of the top two tax rates are merely passive investors who have nothing to do with running the business. This is because the Tax Policy Center data cited above use the Treasury Department’s relatively broad definition of “small business.” Under the Treasury definition, for example, the $84 of income President Bush received in 2001 from a passive investment in an oil and gas company[7] made him a “small-business owner.” About 35 percent of “small-business owners” with incomes above $200,000, and about 58 percent of “small-business owners” with incomes over $1 million, received some or all of their business income in the form of passive investments. The Treasury definition also counts as “small-business income” the fees that CEOs are paid for sitting on corporate boards.

In short, few small businesses see any benefit from reductions in the top two income tax rates. The imagined impact on small businesses is a poor justification for extending the current top two rates, which would increase the deficit by $450 billion over the next ten years. …

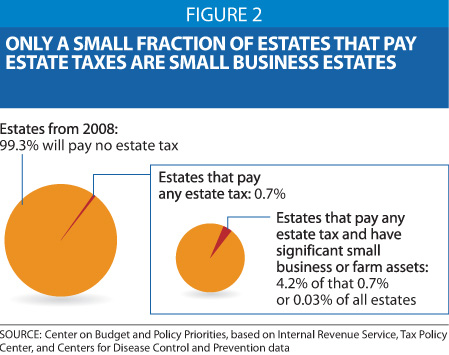

Furthermore, the small-business estates that do owe estate tax generally pay a very small percentage of their value in tax. The 740 small-business estates that will pay any estate tax from deaths in 2008 will pay an average rate of just 8 percent, which is less than half of the 17.9 percent average rate that taxable estates overall will pay this year.[11]

Furthermore, the small-business estates that do owe estate tax generally pay a very small percentage of their value in tax. The 740 small-business estates that will pay any estate tax from deaths in 2008 will pay an average rate of just 8 percent, which is less than half of the 17.9 percent average rate that taxable estates overall will pay this year.[11]

There are two main reasons why. First, since small-business estates tend to have a smaller gross value than other estates,[12] the fact that the first $2 million of any estate is entirely exempt from estate tax ($4 million for a couple) generally protects a greater percentage of the value of small-business estates than it does for other estates.[13] Second, a number of special estate tax provisions targeted to small-business estates allow them to reduce significantly the amount of tax they pay.[14]

As in the debate about the top marginal income tax rates, concerns about small businesses under the estate tax are unwarranted.

Eliminating Tax Breaks for Hedge-Fund Managers Would Not Harm Small Businesses

Finally, critics have charged that a proposal the House passed this summer to no longer allow private equity fund managers with multi-million-dollar incomes to pay tax at lower marginal rates than most middle-income Americans would “hurt small businesses.” This claim, too, is incorrect.

Currently, executives who manage investment funds are able to receive a portion of their compensation in the form of “carried interest” (i.e., a share of the profits of the investment fund) and pay tax on it at the capital gains tax rate, which is typically much lower than their marginal income tax rate. Such preferential treatment for carried interest compensation is difficult to justify. While these executives’ compensation is calculated as a percentage of profits, they cannot accurately be viewed as earning shares of the profit of the investment fund, since they have not contributed any capital to the fund.

The House proposal would require carried interest compensation to be taxed at the recipient’s marginal individual income tax rate. This is a reasonable proposal to eliminate an inefficient and inequitable loophole. Furthermore, the proposal would use the $31 billion that closing this loophole would save over the next decade to help prevent millions more taxpayers from becoming subject to the Alternative Minimum Tax.

One response to this proposal has been the familiar but baseless refrain that the proposal “could affect countless ‘mom and pop’ businesses along Main Street, U.S.A.”[16] However, taxing carried interest in the same way as ordinary income would only affect individuals who provide investment management services and are paid in the form of carried interest. It would have no effect on small-business proprietors or individuals starting up small businesses, except for people who set up and run investment management firms. Indeed, when the director of Congress’s Joint Committee on Taxation was asked about the provision’s impact on “mom and pop” operations, he jokingly replied, “mom and pop private equity firms?”

.

.Many of the roughly 650,000 filers with small-business income who face one of the top two tax rates are merely passive investors who have nothing to do with running the business. This is because the Tax Policy Center data cited above use the Treasury Department’s relatively broad definition of “small business.” Under the Treasury definition, for example, the $84 of income President Bush received in 2001 from a passive investment in an oil and gas company[7] made him a “small-business owner.” About 35 percent of “small-business owners” with incomes above $200,000, and about 58 percent of “small-business owners” with incomes over $1 million, received some or all of their business income in the form of passive investments. The Treasury definition also counts as “small-business income” the fees that CEOs are paid for sitting on corporate boards.

Furthermore, the small-business estates that do owe estate tax generally pay a very small percentage of their value in tax. The 740 small-business estates that will pay any estate tax from deaths in 2008 will pay an average rate of just 8 percent, which is less than half of the 17.9 percent average rate that taxable estates overall will pay this year.[11]

No comments:

Post a Comment