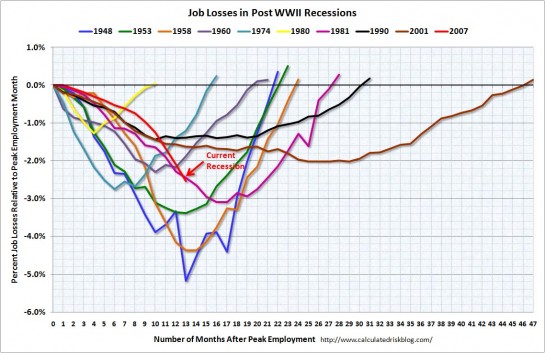

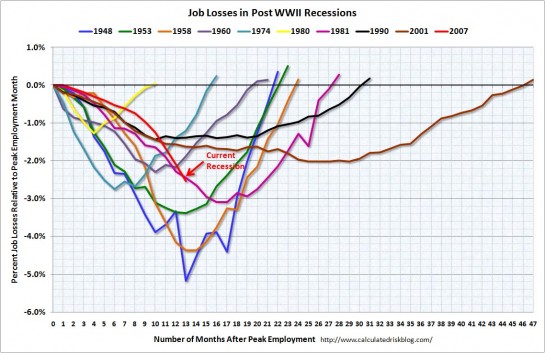

From this perspective it doesn't yet look worse than a number of other Post WWII recessions.

Humans—smart enough to have ideas; foolish enough to believe them

Amazingly optimistic. They don't ever seem to recommend selling anything!

Amazingly optimistic. They don't ever seem to recommend selling anything!

Obama has added or talked about adding several new cabinet-level positions, such as chief technology officer, climate czar, and car czar. How about an advisory cabinet of economic thinkers who can offer the president big ideas for a 21st century economy?

A good place to start would be among those who sounded the alarm about our current financial crisis -- all of whom are critical of the short-sighted, ad-hoc nature of the stimulus bill. People like Nouriel Roubini, the New York University economist who was so prescient about the collapse. Lawmakers, he says, are 'injecting populist politics into economics decisions. Companies and sectors that should be left to drown are being floated lifeboats.'

Jeffrey Sachs, the Columbia University economist who was instrumental in transitioning the economic system of the former Soviet Union, is also no fan of the stimulus bill, calling it a 'a fiscal piñata,' an 'astounding mish-mash of tax cuts, public investments, transfer payments and special treats for insiders,' and 'a grab bag of hasty short-run spending.' He warns that 'without a sound medium-term fiscal framework, the stimulus package can easily do more harm than good.' This is especially true, he says, 'if we allow further tax cuts during a timeof fiscal hemorrhage, or give into 'bipartisan' demands to make the Bush tax cuts permanent."

Joseph Stiglitz is equally leery of the tax cuts that have been included in the stimulus package. "We are in uncharted territory in this crisis," he says. "But household tax cuts, except for possibly the poorest, should have no place in the stimulus. Nor should business tax breaks, except when closely linked with additional investment... Increased investments in infrastructure, education and technology, relief to states, and help to the unemployed need pride of place."

. Holmes' idea is that the

. Holmes' idea is that the banks would … convey [their toxic] assets at year-end, audited book values. … [After such a transfer] the stock prices of the good banks are likely to soar, as they will be the … best capitalized and cleanest banks in the world.Here's what I don't get. If the banks are going to sell their toxic assets at "year-end, audited book values" why don't they just do that now and sell them in the market at that price? If those are real values, there will be buyers. On the other hand, if these "year-end, audited book values" are unrealistically high, the taxpayer is getting screwed, and the bankers, who should be paying the price, get off free.

The government could hire professional money managers, working under an incentive-heavy compensation plan, to oversee the liquidation. (Disclosure: firms like mine might be potential candidates for such a job.)So is that it? Is this all a con to get a lucrative money management contract? I'm normally not that cynical. But I sure can't think of any other explanation. It seems that the only people who are pushing the bad bank idea are those (like bankers and now potential money managers) who will make lots of money from it. Will someone tell me why I'm wrong.

of a biography of Charles Lutwidge Dodgson, better known as Lewis Carroll, John Allen Paulos quotes this puzzle from the book—and from Dodgson's lessons.

of a biography of Charles Lutwidge Dodgson, better known as Lewis Carroll, John Allen Paulos quotes this puzzle from the book—and from Dodgson's lessons. A cup contains 50 spoonfuls of brandy, and another contains 50 spoonfuls of water. A spoonful of brandy is taken from the first cup and mixed into the second cup. Then a spoonful of the mixture is taken from the second cup and mixed into the first. Is there more or less brandy in the second cup than there is water in the first cup?This is a nice example of a problem that's trivial if you know how to look at it and more complex if you approach it in a straightforward, brute force way. One could do the calculation. It's not that difficult. But the easy way to see that the amount of brandy in the water cup is the same as the amount of water in the brandy cup is to realize that both cups end up with the same total amount of liquid—the same amount as they started with, 50 spoonfuls. A certain amount of brandy is in the water cup. The amount of water that was displaced was transferred back to the brandy cup. Therefore, the two amounts are the same.